Product Focus

Services

Special Situations

Special situations are events, either financial or operational or else, which cause businesses to stop operating as usual and which have a material impact on their value. When one of these events materialises the company goes through a crisis or at least a short term transition period which needs to be skilfully managed. The company may need to refinance its debt, or just a short term liquidity facility, or a more fundamental reshaping of its capital structure which may imply finding a an equity partner or equitizing part of the existing debt. The company may also need operational restructuring in order to tackle successfully new products or market challenges.

Exito Partners has access to a wide network of investors and industry specialists who have the expertise and stamina to bring companies successfully through both financial and operational turnarounds.

Capital Raising

Exito Partner’s network of investors extends beyond Europe and the London market and the firm is trusted by investors also in US & Canada (through a chaperoning agreement), as well as parts of Asia and the Middle East. Investors include pensions funds, private equity funds, family offices, and HWNI who are constantly looking for new investment or co-investment opportunities, and not limited to the distressed and special situations sector.

Exito Partners is particularly interested to hear from parties that are looking to raise only part of the funds for a particular project in order to find a co-investor and thus manage their own risk.

Exito Partner can quickly assess the merit of an investment opportunity and organise accordingly one-to-one meetings with selected investors, participations into specialised industry conferences and road shows.

Thanks to extensive relationships with banks and other financial institutions Exito Partners can also raise capital in the form of debt financing.

NPL Portfolio Solutions

The general consensus is that we are facing another decade of NPL portfolio deals thanks to the ECB policy, and that of other central banks, of forcing commercial banks to clean up their balance sheet from bad loans. Furthermore, investors think that likely interest rises, geopolitical conflicts, and Brexit are important macroeconomic factors that will continue driving the restructuring of European banks balance sheets in 2018. Exito Partners thinks that geographic areas of particular interest and focus will continue to be Southern Europe but also Ukraine, Russia, India, Turkey, and China.

Exito Partners provides valuations, structuring, and sale services to financial intuitions that have to navigate the uncharted waters of a NPL portfolio sale transaction, whereby due to the very illiquid nature of the assets classes, extraction of a fair value price for the assets is a very challenging and time consuming endeavour particularly when attempted for the first time.

Our firm is capable of supporting clients throughout the sale process and find the best strategy or solution to maximise value and execution probability of a NPL portfolio sale.

Structured solutions

Often a solution to a problem requires thinking outside the box and coming up with something bespoke and creative.

A structured solution is looking at the financial problem differently, yet in a way that still manages to achieve maximisation of the eventual outcome. A structured solution more complex than perhaps the plain vanilla equity investment, debt issuance, or outright sale of an NPL portfolio, and often implies bringing two parties together in sharing the outcome and success of a financial transaction.

Exito Partners has worked with many financial institutions and devised various structured solutions in the shipping, infrastructure, real estate and NPL sectors. We pride ourselves on delivering best value for our clients and ultimately exploring all available options.

Benefits of Working With exito partners

Assets type

Corporate

- Syndicated, Club & Bilateral Loans

- Private Placements

- Corporate Loans

Infrastructure

Infrastructure

- Renewable Energy

- Conventional Energy

- Transport

- PFI/PPE

Shipping

- Containers

- Bulkers

- Tankers

- Specialised on/off shore

Real Estate

- Commercial

- Residential

- Land plots

Specialism

Exito Partners specialises in providing advisory services and solutions to financial institutions to assist them in meeting their regulatory capital requirements:

i. Confidential execution and sale of non-core portfolios of illiquid credit and distressed assets

ii. Providing advice on and implem- enting synthetic or structured portfolio solutions to minimise the capital and P&L impact

Experience and Track Record

The team comprises of senior Bankers with significant transaction experience gained from Tier 1 Investment Banks

i. Executing the first NPL loan portfolio transaction in Ukraine and the largest single name corporate sale in Slovenia

ii. In the last 12 months alone, Exito Partners have been the exclusive sales advisor to over $1 billion of credits and asset sales

Unique Proposition

Exito Partners will assess all options from an outright sale to a synthetic or structured solution with the aim to deliver the most effective solution for the client

i. competitive: We do not charge a bid/offer spread; we will make a highly competitive fee proposal aligning our success fee with our clients’ desired goals

ii. transparent: We provide complete investor and price transparency to our clients and their decision making bodies

Investors

Investment Criteria

- Yield

- Level of Distress

- Minimum Ticket

- Currency

- Duration

- Majority or Minority Debt Position

- Pre or Post Restructuring

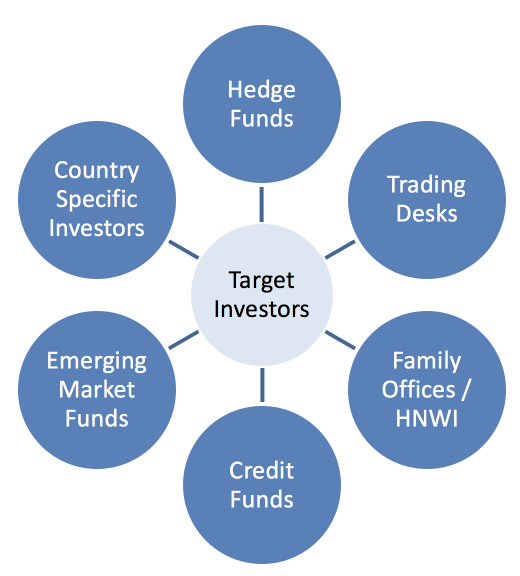

Exito Partners Target Investors

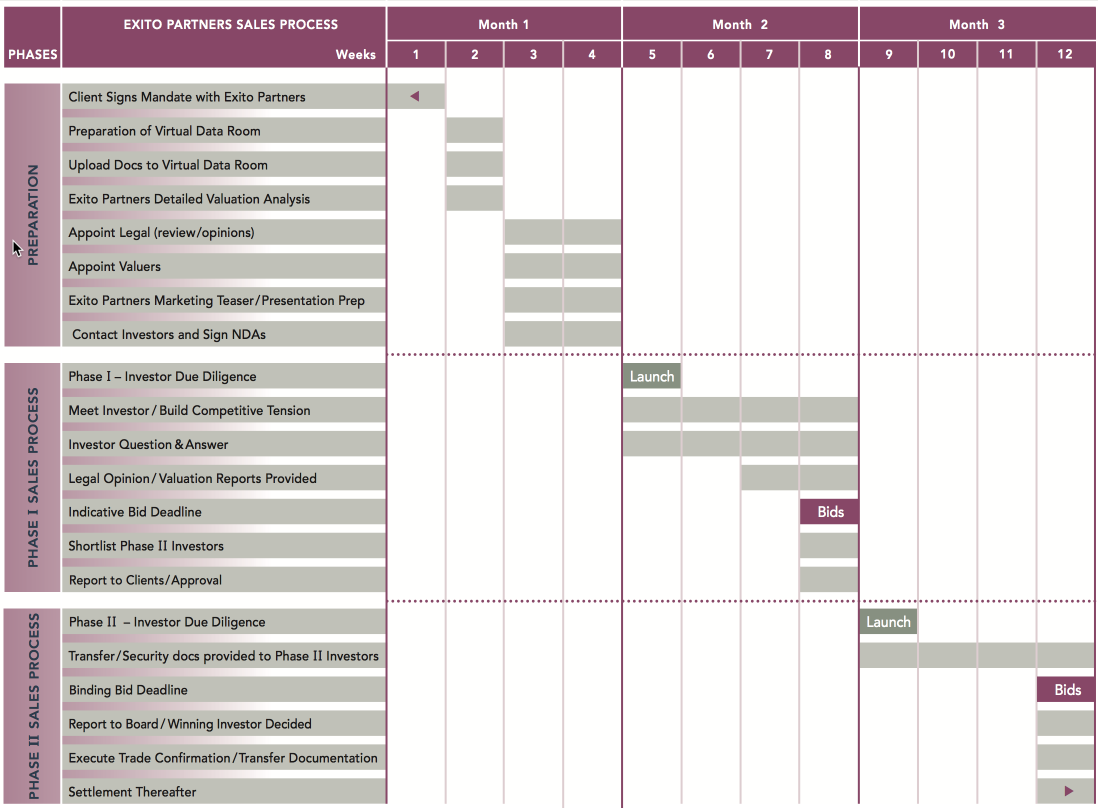

Our sale process

Exito Partners believes that our projects, weather is a NPL portfolio sale, or a special situation transaction, or a capital raising mandate, can be completed within 12 weeks from being mandated.

The exact timeline will partially depend on the exact nature of the project and on the quality & availability of the information and internal approval processes.

Assuming data collation and information integrity are completed to a reasonable standard, a transaction could be launched to the market within a short period of time.

Exito Partners will ensure our clients receive full and regular feedback on the sale process and will ensure transparency throughout the process so that investors have the confidence to participate to a project that is real, effective, and with a very high probability of being completed successfully.

Example of Timeline for a NPL portfolio sale